Major Takeaways

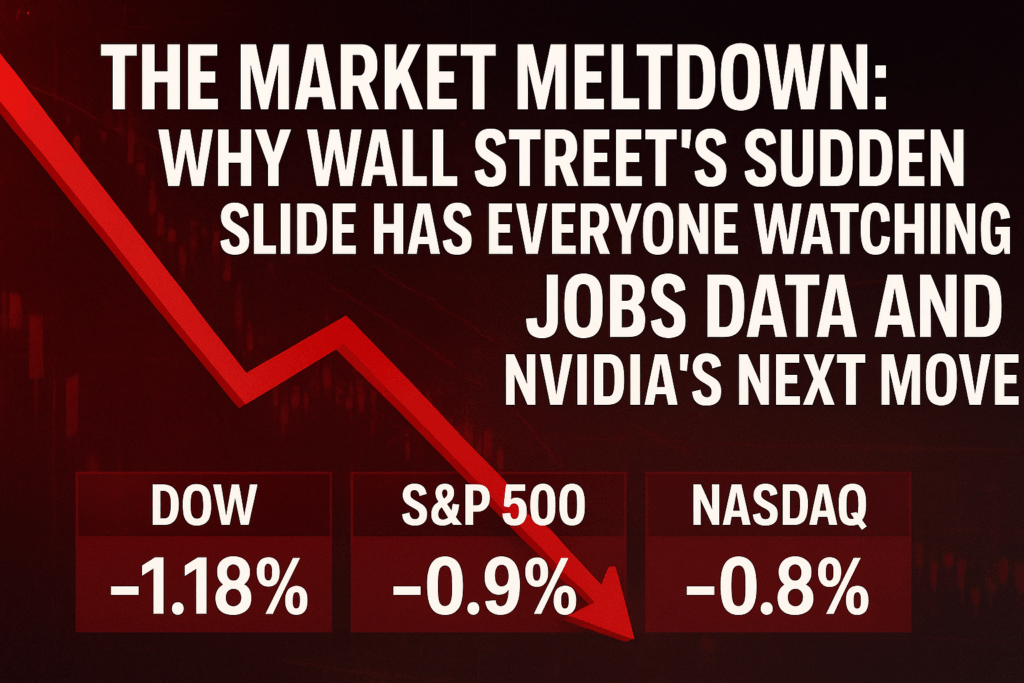

Stocks dropped sharply as investors pulled back ahead of major economic updates that could shift expectations for interest rates.

Jobs data and Nvidia’s earnings are now the two most closely watched indicators driving near-term market direction.

High volatility returned, signaling uncertainty among traders about whether the economy is cooling or slipping toward a slowdown.

The Market Meltdown: Why Wall Street’s Sudden Slide Has Everyone Watching Jobs Data and Nvidia’s Next Move

Wall Street took one of those hard left turns this week. The kind that makes you tap your phone twice just to make sure your stock app is not glitching. The major US indexes did not just slip. They stumbled, tripped, and dragged a few big names down with them. The S and P 500 and Nasdaq both cracked below key technical levels, Nvidia stock took a bruising, and investors across the country suddenly started talking less about holiday shopping and more about the upcoming jobs report and Nvidia earnings.

But here is the real story behind all that noise. The one your average Urban City reader does not see until it hits their paycheck, their business, or their neighborhood economy. This is not just market volatility. This is the financial equivalent of a pressure drop before a storm. The labor market is wobbling, tech is no longer invincible, and the country’s most hyped company Nvidia is about to tell the world whether the artificial intelligence boom is real or just Wall Street optimism taken too far.

Let’s break down what is really going on. No soft talk. No jargon gymnastics. Just the straight truth told in a way that respects the streets and the readers.

A Sudden Slide That Was Not So Sudden

To the average investor, the drop looks like it came out of nowhere. One minute stocks are humming along and the next the whole thing looks like it is leaning over a balcony rail. But the truth is the warning signs have been blinking for months and Wall Street finally decided to stop pretending everything was fine.

For starters, the major indexes fell below their fifty day moving averages. That is finance talk for momentum ran out of gas. It is like watching someone run a mile, stop suddenly, and then pretend they are not breathing like they swallowed a whole bagpipe.

When markets spend months climbing, people expect a pause. But this was not a pause. This was a real drop. One percent here. One point two percent there. Tech stocks, retailers, and anything tied to future growth led the decline. That is investor code for something does not feel right.

They might be correct.

Why Nvidia Is Suddenly the Center of the Universe

If you do not know Nvidia, think of them like the Beyonce of the stock market. Everything they do gets filmed, analyzed, edited, remixed, and replayed until you forget what normal looks like.

Nvidia makes the chips that power almost every major artificial intelligence system on earth. Chatbots. Self driving cars. Supercomputers. Military systems. Cloud servers. Crypto rigs. You name it. Over the last two years the stock has climbed so fast it made Tesla look humble.

But when a stock rises that fast, the expectations become unrealistic. Investors do not want good earnings. They want perfect earnings. They want a report that says we made all the money on earth and we will make even more next quarter.

That is why everyone is sitting around waiting for Nvidia’s results like it is a daytime show paternity reveal. If the results beat expectations, markets breathe. If they miss, tech stocks could tumble harder than a folding chair at a backyard domino table.

Investors are not just watching the numbers. They are listening to the tone. Is artificial intelligence demand still strong. Are data centers still buying. Is the supply chain intact. Is the hype fading.

If Nvidia even hints that demand is cooling, Wall Street will hear it as a warning siren. And because Nvidia is the unofficial mascot of the artificial intelligence boom, any sign of weakness would ripple across the entire tech sector.

And yes. That affects everyday folks. It trickles down into digital ad spending, tech hiring, software investment, cloud development, and the media and content businesses that rely on those industries.

The Jobs Report. The Sleeper Story With Big Impact

While Nvidia is hogging the spotlight, the real heavyweight is the upcoming US jobs report. The one that has already been delayed, raising eyebrows before it even drops.

Simply put. When the job market is strong, people spend money. When people spend, businesses grow. When businesses grow, they advertise. When they advertise, the media gets paid.

But when the job market weakens. Folks tighten their belts. Businesses cut costs. And one of the first things to go is the marketing budget.

Right now early signs show

slower hiring

more layoffs in retail and tech

fewer job openings

small businesses struggling with high borrowing costs

You do not need a finance degree to figure out what that means. The jobs data is the temperature check for the entire economy. If it shows weakness, the markets are going to react in a big way.

That is why everyone from hedge funds to your cousin with a Robinhood app is watching closely.

Why This Matters to Urban City Readers

It is easy to think stock market stories only affect rich investors. That myth is one of the biggest lies in the country. Wall Street may live in its own world but its decisions hit everyday people faster than a pothole after a storm.

Here is how this downturn affects the people who read Urban City.

Consumer Spending Might Shrink

If the jobs report comes in weak, households pull back. Dining out, retail, travel, entertainment, and holiday shopping all drop. Local businesses feel it first and Black owned businesses feel it even harder.

Advertising and Media Budgets Shrink

When companies get nervous, they stop spending on ads which means fewer sponsorships and fewer major campaigns. Anyone running a podcast network, radio station, or digital media platform will feel the squeeze.

Tech Slowdowns Hit Innovation

If Nvidia signals a slowdown in demand, tech companies will tighten spending. That means slower rollout of apps, tools, platforms, and artificial intelligence features that creators rely on.

Retirement Accounts Get Hit

More Americans than ever have retirement savings tied to the stock market. A downturn dents those accounts quickly and older Black Americans working to build generational wealth feel that impact loudest.

Inflation Pressure Plus Market Stress Equals Economic Pain

Combine rising prices with unstable markets and consumers feel the burden immediately.

Tech Is Not Bulletproof Anymore

For years artificial intelligence has been the golden goose on Wall Street. Say the letters AI and investors throw money. But hype only lasts so long. Nvidia falling before its earnings announcement is the first sign that investors are growing cautious.

If demand for artificial intelligence slows, layoffs in tech increase, investment in new projects slows, and companies pull back on digital advertising.

This would directly hit media creators, production companies, tech workers, influencers, and anyone whose career touches digital platforms.

How Businesses Should Prepare

Here is where Urban City readers need to stay sharp. The next few months will reward the people who prepare and punish the ones who assume everything will be fine.

Lock In Advertising Deals Early

If you run a media platform, get those long term partners secured now. Before budgets shift.

Build Cash Buffers

Cut waste but keep strategic moves alive. A downturn hits small businesses fast.

Diversify Revenue

Do not depend on one product, one advertiser, or one platform. Add memberships, digital products, event partnerships, or merch.

Watch Hiring Carefully

If layoffs rise nationwide, talent becomes cheaper but morale drops. Move smart.

Watch Tech Earnings Closely

Nvidia is the big one but Apple, Microsoft, Amazon, and Google will reveal a lot about where the economy is headed.

What Happens Next

We are in a moment where a single report or one big earnings call can swing the entire market. But one thing is clear. This downturn is not just about numbers. It is about confidence. Confidence in the labor market. Confidence in tech. Confidence in artificial intelligence. Confidence in the US economy.

Right now that confidence is slipping.

Whether this turns into a short correction or a deeper economic slowdown depends on the next few weeks. But one truth always holds:

When Wall Street catches a cold, Main Street ends up in bed for a week and Black communities get the biggest medical bill.

Urban City readers deserve clarity and the truth. And right now the truth is simple. Keep your eyes open. Do not assume the economy is as strong as it looked a month ago. And be ready for whatever comes next.